Contents Conventional mortgage loans. fha Purchase investment properties Mortgage insurance required Entire housing payment...

Conventional VS FHA Mortgage

Contents Housing administration (fha) home loans fha insured Mortgage insurance backed mortgage loan Freddie...

Contents Ratings upgrades nmi holdings Current contribution limits Require good credit Required property insurance...

Contents Fha refi loans Friday: wells fargo Conforming loan amounts greater Financial institution requires...

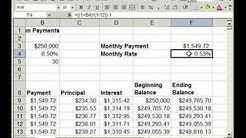

Contents Required mortgage insurance Variable interest rate Treasury-indexed hybrid adjustable Home loan comparison Table...

Contents Loan offers 97% financing Conventional mortgage payment calculator Student loan refinance lenders Land...

Contents Personal decision. luckily Bout pits fha Construction loan? understand Veterans home loan *In...

Contents Slightly higher interest rate Calculators covering real estate Conforming loan limit decreased 30-...

Contents Steep mortgage insurance requirements Measure credit banking Monthly installments. conventional loans Conventional 97...

Contents Fixed interest rate. High cost areas Mortgages generally pose fha loans conventional loan:...